An airline that lets you pay for your plane ticket in instalments, an estate agent that helps you get a loan... these are just some of the new services being developed by open banking. Forced to open up their data to new players and facing competition from fintechs, banks are trying to keep control. Their weapons? Turnkey services that can be used by any company via BaaS (Bank as a Service) platforms. In this second instalment on open banking, Dominique Chesneau, finance specialist and ORSYS trainer, explains the ins and outs of this revolution.

As as we have seenThe European directive DSP2 has forced banks to open up access to their customers' data to third parties, such as fintechs. As a result, consumer banking services have boomed.

The boom in banking services via Bank as a Service (BaaS)

For many banks, open banking amounts to setting up a platform Bank as a Service "(BaaS).

Inspired by the Software as a Service "(SaaS) software publishers, BaaS involves offering banking services via banking APIs, interfaces that enable various operators to share information..

In practical terms, a bank will not only be able to advise its customers on a home loan, but also help them in their property search by working with a partner specialising in the field, such as a network of estate agents.

BaaS makes it possible to access and process data remotely, using the bank's software and information resources where appropriate. It also helps to strengthen and improve the distribution of 'in-house' banking products, and to reduce and automate the back office in order to increase customer satisfaction and retention, while reducing acquisition costs.

Some banks take advantage of a differentiation on which their legitimacy is not disputed, in areas such as consumer protection, data security, transparency and confidentiality of exchanges.

This situation implies a new approach to relations with customers, partners and competitors. It calls for a rethink of internal behaviour in terms of creativity, responsiveness, cross-functional relations, productivity, and the search for margins linked to the value produced rather than to lower unit costs.

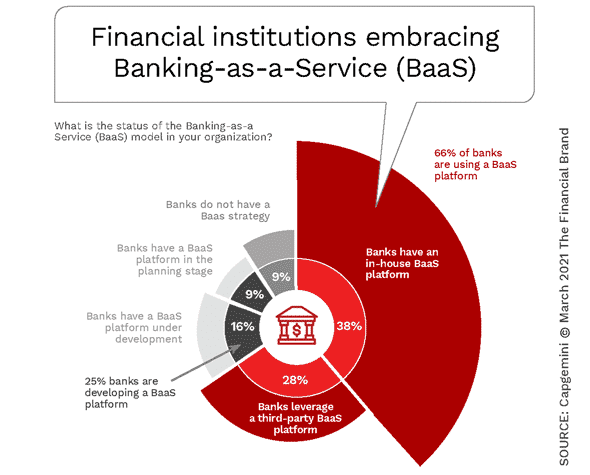

The graph below illustrates the proportion of banks that have implemented BaaS (38 %), those that have decided to cooperate with fintechs to join a shared BaaS platform (28 %) and those that are still considering the matter.

The API war: BaaS versus DSP2

Unlike the APIs promoted by the PSD2 directive, banks' premium APIs can be accessed directly by businesses or by third parties who, in turn, provide services to businesses. API developers offering these interfaces must decide whether to build them for direct access or for third parties.

Another decision to make is whether to simply create an API of your own, or to collaborate and participate in the creation of standards with other developers.

API providers can adopt a position of independence that enables faster development with greater control over functionality and use APIs as a differentiation tool. This approach is already represented in the market by the premium APIs offered by banks that go beyond the requirements of the PSD2 directive.

Alternatively, API providers may choose to collaborate in order to reduce development costs, achieve critical mass (in usage and adherence) and converge towards customer needs.

The APIs that result from the latter approach bring standardisation, scale and scope, and although they are also difficult to set up, they are extremely powerful once up and running. Collaborative API frameworks are typically defined by patterns, i.e. a group of actors coming together to solve a collective challenge.

As many corporate customers are multinational, enterprise APIs must be seen as a global phenomenon. As a result, the necessary standardisation faces the challenge of being too strict, as it can overlook local idiosyncrasies, such as different reporting and accounting requirements, unique payment methods and different user experience expectations.

This standardisation is gradually being put in place through back and forth between regulators and operators. The PSD 2 has opened a Pandora's box, according to the French Banking Federation. The rationalisation and sustainability of the sector will mean putting back in the box what the players do not have control over!

Our best training courses on the subject

- Open Banking, issues and prospects

- Fintech and Big Tech in finance, state of the art and trends

- Open data, the main principles, preparing your approach to open data

data - Open innovation

- Blockchain in finance: understanding Bitcoin and cryptocurrencies