Changing our approach to environmental challenges. The idea is gradually gaining ground in economic and financial circles. The negative externalities produced by human activities have become major risk factors for the economy.. As a result, we need to go beyond conventional reporting. So what does this new approach involve? What are the challenges for accounting and finance? What does sustainable finance cover? Teddy Turmel, corporate finance consultant and trainer, takes a closer look.

Until very recently, company reporting documents consisted exclusively of financial data. As a result, environmental considerations such as the depletion of natural resources, pollution and climate change were ignored.

Today's environmental situation is forcing us to rethink the conceptual framework of finance. This is where non-financial accounting comes in. The aim of this new approach is to take into account the economic, social and environmental impacts of a company's activities.

With this in mind, the Conseil supérieur de l'ordre des experts-comptables (CSOEC), via its Extra-Financial and CSR Standardisation Committee, has organised the 1ᵉʳˢ États généraux de la comptabilité extra-financière, on 23 November 2022.

But the plethora of concepts that make up extra-financial reporting is hard to navigate, corporate social responsibility (CSR), environmental management control, sustainable finance, CSRD, TCFD...

In an attempt to shed some light on the subject, here are the three areas we are looking at: extra-financial reporting, environmental management control and CARE accounting.

1. Non-financial reporting

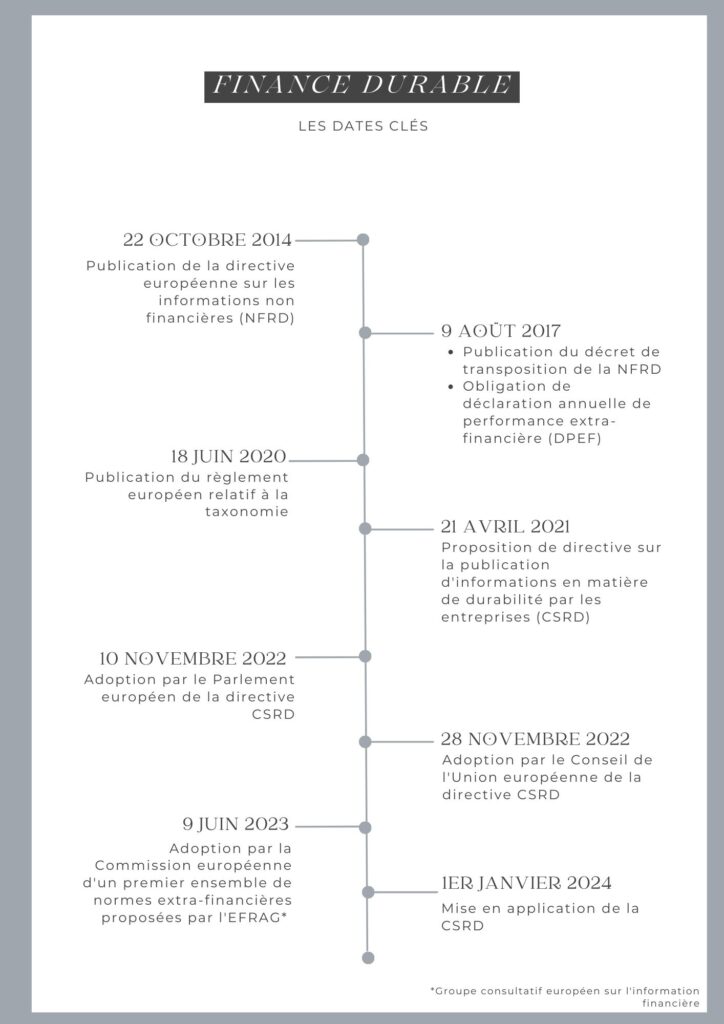

In October 2014, the European NFRD (Non Financial Reporting Directive) provided for the publication of information on environmental protection. In January 2024, a new directive will come into force: the CSRD or Corporate Sustainability Reporting Directive. It concerns the publication of sustainability information by companies. It will replace the NFRD. This directive was proposed on 21 April 2021.

From January 2024, companies will be required to publish non-financial reports covering environmental, social and societal issues. Here are the main changes in detail:

- More companies will be affected, in particular all those listed on European regulated markets;

- standardisation of obligations. Companies will have to publish detailed information on their social and environmental impacts on the basis of harmonised European standards;

- a single location and format. Reporting will be published in a specific section of the management report and in a single European electronic format;

- compulsory verification of the information by a statutory auditor or an independent third-party body.

Non-financial reporting is therefore an integral part of a sustainable development approach. It also makes it possible to measure social responsibility through indicators and tools such as the TCFD (Taskforce on Climate-related Financial Disclosures) and the new CSRD directive.

2. Environmental management control

The concept of sustainable development has had a long life and is still very inadequate in the face of environmental realities.

These environmental challenges require the introduction of a new component to the management control. This component integrates environmental performance and anticipates the risks inherent in human activities.

Environmental management control is a process designed to implement an organisation's green strategies. By green or environmental strategies we mean taking account of the natural environment in the organisation's competitive, political and industrial strategies.

This new approach encourages reflection on key financial concepts such as :

- wealth creation. It can no longer be exclusively financial. It must necessarily include key concepts linked to the preservation of the living world (biodiversity, water, pollution, etc.);

- performance. How can we integrate non-financial indicators to measure real performance, taking into account our natural heritage?

- efficiency. It must include not only financial and human resources, but also and above all natural resources that are absolutely vital for life on earth.

Lastly, the risks induced by human activities require risk mapping to be redefined. For example, climate change and its consequences, such as heatwaves, droughts and floods, create major systemic risks.

The role of environmental management control is to prevent and control the occurrence of these "new" risks.

3. CARE accounting

Accounting as it is currently practised is completely out of step with the physical realities of our environment: the limits of raw materials and energy, the generation of waste, pollution, etc.

The reasoning we have always adopted is based on stock accounting rather than flow accounting. In other words, it is as if resources were unlimited and growth potentially infinite.

Hence the need for a new approach. The CARE method (Comprehensive Accounting in Respect of Ecology) aims to take account of the annual degradation of natural resources in companies' financial accounts. Its corollary? The conservation of ecosystem heritage.

In particular, it aims to measure social and environmental issues such as natural capital, and takes greater account of the limits of ecosystems.

CARE accounting is in line with the concept of strong sustainability in economics. It makes it possible to identify the actions of an organisation that are genuinely compatible with the preservation of ecosystems.

Here are a few examples of how traditional accounting principles have been adapted to this new method:

- principle of non-compensation which is based on the idea of the substitutability of capital in the economy - the idea that capital is substitutable or exchangeable.

This simplistic principle does not correspond to physical reality. We therefore need to take account of the limits and non-replaceable nature of certain resources (water, air, etc.);

- principle of prudence to measure the environmental and human capital affected by the company's activities. The deterioration of these assets is accounted for through depreciation in the balance sheet (calculation of the cost of maintaining these assets).

The bottom line: in the face of current and future environmental challenges, finance will either be sustainable or it won't be. It must reinvent itself through intelligent non-financial reporting, management control that anticipates and prevents ecological risks, and accounting standards that make sense and do not ignore physical and biological realities. It remains to be seen whether it will be up to the challenge.