European tax regulations have just changed. That's why companies need to adjust their tax optimisation strategy. The slightest misstep on this narrow ridge and the company will fall into fraud. Tax compliance expert and trainer Julien Briot-Hadar explains the new regulations and the risks, penalties and impact they can have on your company's finances and reputation.

The figures are not anecdotal. The latest parliamentary report on tax evasion, drawn up in October 2022 by Charlotte Leduc, the Member of Parliament for Moselle, estimates the loss to public finances at between €50 billion and €120 billion a year.

This is why the public authorities, through European and international bodies, are increasing the number of regulations they introduce to try to curb tax evasion and draw a clear line between tax fraud and tax optimisation.

In the collective mind, the concepts of tax evasion, tax avoidance and tax optimisation are often lumped together.

As a reminder, tax fraud is an offence defined by article 1741 of the General Tax Code (CGI). Any person who fraudulently evades or attempts to evade the assessment or payment of all or part of tax is guilty of tax fraud.

Tax optimisation aims to reduce its level of taxation. It can be legitimate or aggressive.

- Legitimate tax optimisation is a legal tax avoidance mechanism. In particular, it consists of exploiting tax niches or exemption schemes.

- Aggressive tax optimisation consists of taking advantage of the subtleties of a tax system or the inconsistencies between the tax systems of several countries in order to reduce the tax payable, as defined in the Ministry of the Economy website.

The Irish double and the Dutch sandwich

One of the main methods used is to manipulate transfer prices, i.e. cross-border transactions between subsidiaries of the same group, in order to reduce the tax rate on profits. The "double Irish" technique, otherwise known as the "Dutch sandwich", involves using subsidiaries and holding companies registered in offshore financial centres to take advantage of the laws of these countries.1. The regulatory framework is being strengthened

New regulations are aimed at increasing tax transparency and combating fraud. These include the European directives known as DAC 6, DAC 7 and ATAD 3, some of which will not come into force until 2024 at the earliest, but companies need to anticipate and prepare for them.

I) The DAC 6 directive to combat tax evasion

Since 2021, companies and their intermediaries have had to declare to the tax authorities any cross-border arrangements that are potentially aggressive from a tax point of view, as long as they meet certain criteria, known as markers.

This is known as the DAC 6. This European directive introduces an automatic exchange of information on potentially aggressive cross-border tax arrangements. Its aim is to enable tax authorities to react more quickly to aggressive tax avoidance schemes.

In June 2022, the McDonald's group avoided a trial and settled its dispute with both the tax authorities and the public prosecutor by agreeing to sign this judicial public interest agreement (CJIP) with the Parquet national financier (PNF). The fine amounted to approximately €1.2 billion.

The dispute between McDonald's and the tax authorities concerned an aggressive tax planning scheme.

Between 2009 and 2020, abnormally high brand royalties were transferred from France to Luxembourg. These intra-group transactions had the effect of reducing taxable profits in France, the multinational's second largest market.

The arrangement "absorbed a large part of the margins generated by the French restaurants and undermined the tax paid in France by the various structures of the French group", noted the president of the court, Stéphane Noël.

II) The DAC 7 directive tackles digital platforms

The successor to DAC 6, the so-called DAC 7 directive obliges platform operators to declare information on the income received by sellers on their platforms, and Member States to exchange this information automatically. The aim is to enable local tax authorities to identify the income received by sellers via digital platforms and to determine the relevant tax obligations. It will come into force on 1 January 2009.er January 2024.

III) The ATAD 3 directive against shell companies

Following a request from the European Parliament and the financial scandals (Pandora Papers, LuxLeaks, OpenLux, etc.), the European Commission has published draft Directive 2021/0434 or ATAD 3 aimed at preventing the use of shell companies. Its transposed provisions should be applicable from 1 January 2024, with the need to assess certain criteria as early as this year.

The scheme is aimed primarily at intermediate holding companies set up by multinational groups, investment funds, private equity funds and family offices.

To be covered by the new directive, the entity must meet three criteria:

- More than 75 % of the holding company's income over the last two years must be passive or similar income;

- More than 60 % of a company's revenue comes from cross-border transactions or more than 60 % of the company's balance sheet is made up of property assets or assets for private use located abroad;

- The management or administration of the entity has been outsourced.

The directive aims to harmonise the definition of shell companies and penalties.

To answer the question of substance, they must have premises in the country, hold a bank account in the European Union and have a director resident in the State where the entity is located. If the tax authorities consider that the entity has no substance, it will be deprived of the benefit of numerous tax relief measures: competitive advantages, parent-subsidiary regime, etc.

In France, tax returns are filed on the taxpayer's own website, impôts.gouv.fr.

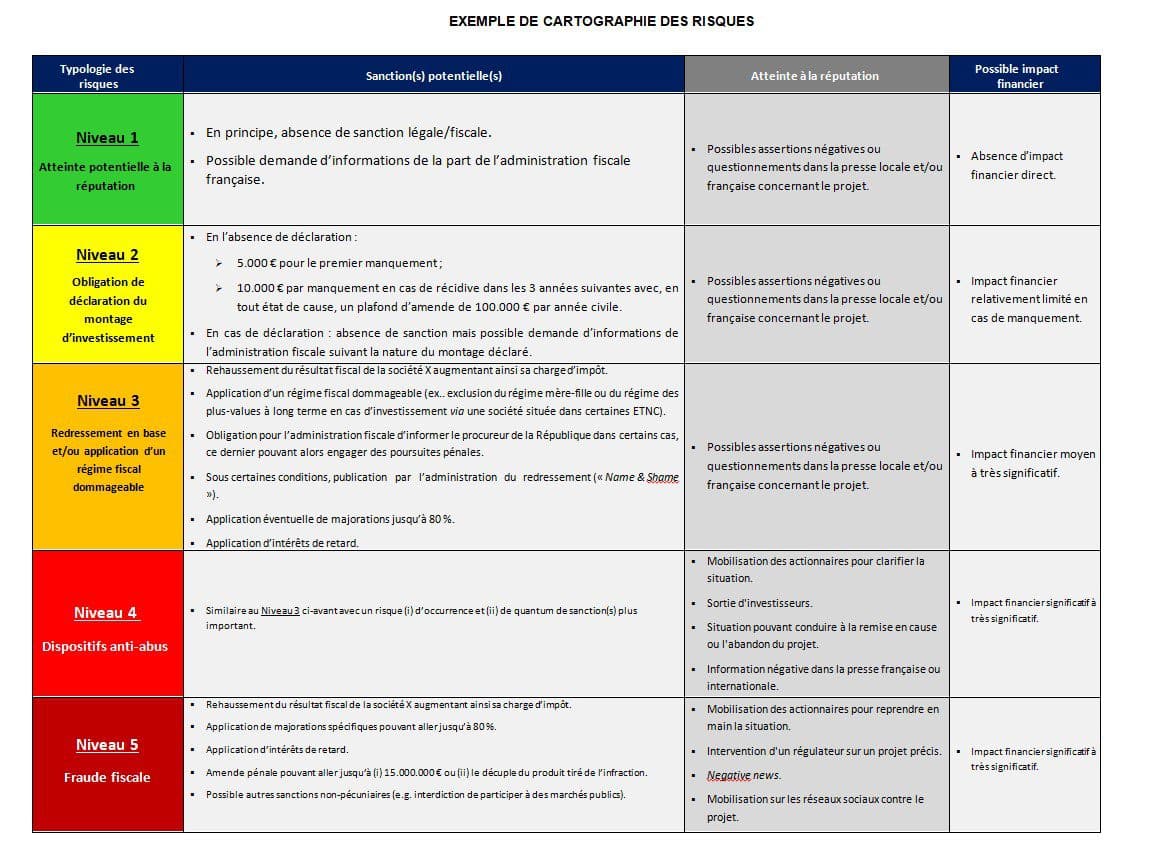

For DAC 6, in France, the first error is €5,000 and the ceiling is €100,000 per company (or per legal entity) per year. A tax compliance problem also entails an image and reputation risk that can compromise the value and even the survival of the company.

2. Measures to be implemented

There is a real need to train teams to detect devices likely to be affected by DAC 6. Companies often call on outside firms, such as corporate law firms for the theoretical aspect or tax compliance consultants for the practical aspect. During these training sessions, it seems essential to ensure that everyone has a comprehensive understanding of the fifteen DAC 6 markers.

High-quality internal control is also essential. Incorporating tax compliance into the company's policies, procedures and processes is essential if it is to comply with the law. Other points to be addressed in first- and second-level controls with regard to tax compliance are: the notion of cross-border arrangements, analysis of DAC 6 markers, review of types of arrangements, identification of intermediaries, consideration of the secret and the quality of the declarations.

Tax compliance must also be taken into account as part of the periodic audit, in the same way as all the institution's policies, procedures and processes. It would be useful for auditors to be able to retrieve the reports of assignments carried out on tax transparency processes. It also seems essential to take an interest in the governance company's internal control system. Finally, it is absolutely essential to check that tax compliance is taken into account in the company's risk-based approach.

Finally, the company must draw up a series of internal procedures with a DAC 6, DAC 7 and ATAD 3 component in order to prepare itself to comply with these directives.

In conclusion

Tax compliance must be a priority for all companies. It is already having an impact. Regulatory hyperinflation is forcing them to take on new staff, who are necessarily multi-skilled, with both legal and financial skills. Another notable effect is that companies are practising aggressive tax optimisation less and less, fearing that aggressive tax optimisation schemes will be reclassified as tax fraud. Finally, with ATAD 3, companies need to look at the economic substance of each holding company and work meticulously to comply with the regulations by 1 January.er January 2024. So it's best not to leave it to the last minute.