Banks have finally opened up access to their customers' data. The open banking revolution has come and gone. What are the implications for financial institutions? What role What role should they play in the future, particularly in the face of fintechs? What new services are they offering? Dominique Chesneau, finance specialist and ORSYS trainer, explains the ins and outs of this revolution.

What is the concept of open banking?

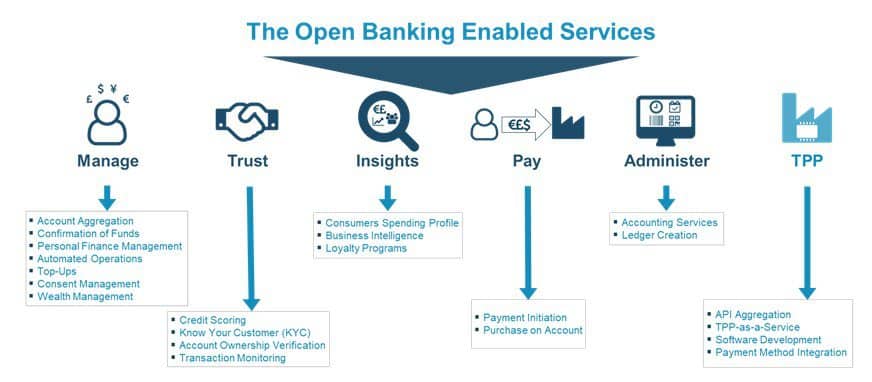

As indicated in previous articlesFor the banks, the aim is to grow by opening up access to their customers' non-confidential data. In return, these same customers can regain power over this data through the use of new services. Open banking is leading these institutions to radically change their business model around the following services:

Services in the Manage (Manage) give users control over their finances, with account aggregation, expense categorisation and automation functions.

Services in the Trust (Trust) improve the identification and analysis of user profiles using financial data. This makes it possible to meet legal compliance obligations or reduce risks.

Services in the Knowledge (Insight) extract banking data by analysing consumer behaviour in order to personalise offers, in particular with loyalty programmes.

Services in the Payments (Pay) allow users to transfer money simply from their bank account.

The services Administer (Administer) can be used to create reports for accounting departments.

The services of third-party service providers (TPPThird Party Providers) allow these operators to enter the banking market and bring added value to consumers.

Open banking expands the financial ecosystem

In addition to payments, all financial players are affected: traditional banks, online banks, fintechs, asset managers, insurers, specialist retail banks and other specialist institutions that use APIs (an API is a programming interface, i.e. code that enables a programmer to establish connections between several pieces of software to exchange data) or marketplaces to reach customers.

This digitisation means reconsidering the technological impact, the acquisition and modernisation of data processing, and the decentralised way in which data is used and distributed by interacting with all the players in the ecosystem:

A new role for banks

In this environment, traditional banks have to change their business model. There are four main strategies open to them:

- “ Full-service provider "The aim is to provide their own range of products and services, without partnerships with third-party companies and therefore without APIs.

- “ Utility "This means relinquishing ownership of products and their distribution. Banks make their infrastructure and services available to other players in the ecosystem, without having any direct contact with the customer.

- “ Supplier "This means offering their own products, but not distributing them via third-party interfaces.

- “ Interface "The aim is to focus on product distribution by creating an interface in the form of a marketplace to which third-party companies can add their products and services.

From the customer's point of view, this development seems obvious, as it :

- enhances the user experience through tailor-made products and services,

- allows you to make wiser financial decisions,

- increases the efficiency and productivity of businesses and SMEs,

- strengthens competition between financial services providers, stimulates innovation, develops new services and increases demand,

- monetises data (by charging third parties for the use of APIs),

- optimises the return on the PSD2 investment (which dilutes the costs resulting from the PSD2 infrastructure),

- creates more value for customers (because APIs enable banks to make personalised offers and strengthen their relationships with businesses)

Just as the exploitation of Big Data has been a massive shift in marketing thinking, open banking makes it possible to exploit the veritable goldmine that banking data represents, in order to develop services that are perfectly matched to consumer needs.

Our best open banking training courses

- Open Banking, issues and prospects

- Fintech and Big Tech in finance, state of the art and trends

- Open data, the main principles, preparing your approach to open data

data