Applicable from 1ᵉʳ January 2024, the European Corporate Sustainability Reporting Directive (CSRD) sets new standards and obligations for non-financial reporting on ESG data (Environmental, Social and Governance). Governance) for your company. What is this directive? Is your company affected? How can you prepare for it? Our expert, Julien BRIOT-HADAR, gives you the keys to understanding and taking action.

Published in the Official Journal on 7 December, the transposition of the European Directive Corporate Sustainability Reporting Directive (CSRD) in French law aims to standardise and strengthen the extra-financial reporting obligations of companies. It requires them to publish very detailed information on their environmental, social and governance (ESG) policy to keep stakeholders informed.

Gradually applicable from 1ᵉʳ January 2024, it replaces the current system. Non-Financial Reporting Directive (NFRD), the French version of which is the declaration of extra-financial performance (DPEF). It broadens the scope of companies concerned from 11,700 to almost 50,000.

If we analyse the reasons for this directive, it seems to be driven by the need to encourage European companies to take action to prevent certain major risks, primarily climate risk. From this point of view, companies, and especially the largest ones, are now expected to make a climate commitment, whereby they must reduce their impact on climate change, or at least try to do so.

Three major changes characterise the transition from EPFD to CSRD: the scope of application, the integration of the company's value chain beyond its strict activities, and the need to formalise progress plans with regard to its most significant financial impacts.

1. Scope of application: companies affected by the WEEE Directive

The due diligence measures arising from the directive will apply from the 2024 financial year to listed companies with more than 500 employees and worldwide sales of more than €40 million. These thresholds are lowered to 250 employees and sales in excess of €40 million for companies where more than half of their sales are generated in a high-impact sector or one considered to pose a high environmental risk, such as the mining sector.

The requirements are less stringent than those set by French law, which in this case are at least 5,000 employees in the parent company and its French subsidiaries, or at least 10,000 employees in the parent company and its French or foreign subsidiaries.

It should be noted that the CSRD rules have an extraterritorial scope, meaning that companies established in a third country are also subject to them if they carry out activities generating more than €150 million on European territory. For the latter, only the criterion of turnover generated in the internal market is taken into account to determine the applicability of the directive's rules. A South Korean company wishing to set up a subsidiary in France would be from facto affected by the CSRD directive.

From the 2025 financial year, for reporting in 2026, this will apply to smaller unlisted companies with more than 250 employees and turnover in excess of €40m.

And from the 2026 financial year, for reporting in 2027, all SMEs and micro-enterprises with more than 10 employees and sales of €700k.

In addition, the CSRD provides for the exercise of due diligence in the context of commercial relations established with suppliers and subcontractors of the company subject to the CSRD. However, the scope of monitoring is extended to the company's entire value chain. The value chain covers all activities linked to the production of goods or the provision of services, including related upstream and downstream activities resulting from established direct and indirect commercial relationships. Quite simply, this means extending due diligence measures to any long-term commercial relationship with a trader, regardless of where in the value chain the trader is located. This choice is open to criticism, as it forces companies to monitor the activities of players over whom they have little or no influence. This criticism is all the more pertinent given that the grounds for liability have been multiplied in the text.

2. Performing a dual materiality analysis

Dual materiality is defined by two different approaches to the inclusion of non-financial information in accounting:

- Financial materiality or simple materiality corresponds to the "Outside-In" vision: this materiality only takes into account the positive impacts (opportunities) and negative impacts (risks) generated by the economic, social and natural environment on the company's development, performance and results. This first dimension therefore concerns the financial aspects: revenues, profits, cash flow, etc.

- Impact materiality or socio-environmental extra-financial materiality corresponds to the "Inside-Out" vision. This materiality takes into account the negative and positive impacts of the company on its economic, social and natural environment, and therefore includes ESG impacts.

In both cases, the assessment of materiality is based on due diligence, monitoring, prevention and correction procedures - which vary according to the nature of the subject to be assessed. It is up to the company to define a procedure that it considers relevant to its activities and scope. When a subject is submitted for study, its materiality depends on several criteria: its scale, its extent, its probability and its irremediable nature. Those already familiar with risk analysis will find similarities here with their existing practices.

The analysis takes place in five stages:

Stage 1 - Pre-qualification of issues

This preliminary stage provides a framework for the exercise and a starting point for getting to the heart of the matter. It involves mapping the company's various value chains, consolidating existing CSR documents and correlating the company's CSR activities with CSRD issues.

Stage 2 - Stakeholder qualification

The quality of the analysis depends on the various stakeholders being approached: prior work is necessary to identify the right players (senior management, employees, customers, suppliers, institutions, external social or environmental experts, etc.), but also to ensure that they are approached at the right level of granularity so as not to make the exercise too tedious.

The following steps can be :

- Identify all stakeholders. It should be noted that EFRAG, the European Financial Reporting Advisory Group mandated by the European Commission, distinguishes between two categories of stakeholders:

- Affected stakeholders (stakeholders), i.e. those that can be positively or negatively affected by the activities of the company or its value chain.

- Information users (users): stakeholders who may have an interest in the company's sustainability report (public authorities, investors, partners, etc.).

- Assessing the strategic nature of each stakeholder by asking two questions: "What is the impact of my activity on the stakeholder? and "How does the stakeholder influence the organisation?

- Connect each part concerned with the ESG issues to which it relates

- Collecting data using channels adapted to each category of stakeholder (conferences, interviews, HR data, etc.), while respecting the RGPD

- Explain the objectives to stakeholders and challenges involved in developing materiality and communicating results

Step 3 - Using EFRAG's methodology to assess the materiality of an issue

In January 2022, EFRAG published a methodology for assessing the materiality of an issue, in the form of an analytical grid.

According to EFRAG, the issue should be analysed in terms of its materiality in terms of impact and financial impact, each of which contains several criteria:

Impact materiality assesses :

- The quality of the impact: whether it is positive or negative

- Type of effect: proven or potential

- The severity of the impact, which is calculated using 3 criteria: the scale of the impact, its scope (scope (i.e. the extent of the impact, on territories and populations), and the remediability [ER1] of the impact.

- Probability of occurrence

Financial materiality is divided into 3 criteria:

- The quality of the issue: positive or negative

- The importance (scale)

- Probability of occurrence

Each issue is also analysed in terms of its impact, risks and opportunities over 3 time horizons:

- Short-term (less than one year)

- Medium term (between 1 and 5 years)

- Long-term (more than 5 years)

.

To date, the company can use a customised rating system (from 1 to 5, for example) to measure the degree of importance, extent and possibility of remediation. Above a certain threshold, the issue is considered material in terms of its impact. The choice of materiality threshold must be justified.

Once this has been done, the company must consolidate its results, i.e. check that the data has been weighted according to the number of stakeholders surveyed and the size of the group and its subsidiaries, on the basis of turnover or full-time equivalents (FTEs).

Stage 4 - Completion of the two materiality analyses

The analysis to be provided is based in particular on the collection of key data from the sector, alignment with the analysis criteria presented above and documentation of the assessment process.

Stage 5 - Convergence of materiality analyses

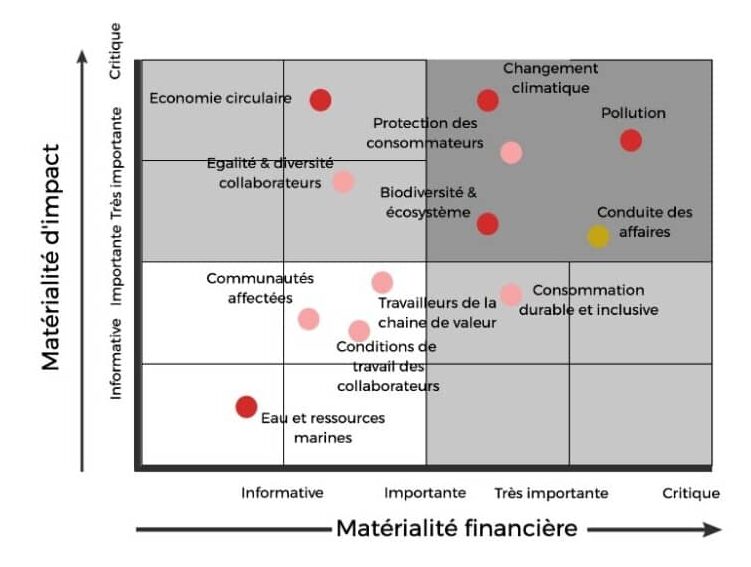

Once the two materialities have been carried out, the results can be analysed to highlight the key interdependencies between the issues, then summarise the various findings in a dual materiality matrix and finally determine which issues are considered to be material.

In conclusion, assessing the materiality of ESG issues is a complex and strategic process. EFRAG's methodology and the requirements of the CSRD guide companies in this process.

This approach starts with a thorough stakeholder mapping, followed by a precise assessment of the strategic impact of each stakeholder on the organisation and vice versa. It is essential to link each stakeholder to the relevant ESG issues and to collect data via appropriate channels, while complying with current regulations such as the RGPD.

ORSYS can help you understand this complex process thanks to its targeted training in both CSR and finance.