Endowments, top-ups, co-construction of training pathways, multiple funders... there are many ways of co-financing your employees' Personal Training Account (CPF). There's also the possibility of transferring DIF (Individual Right to Training) hours to the CPF. This can enable the employee to reclaim up to €1,800 if it is done by 30 June. Communicating on these two aspects, co-financing of the CPF and the DIF, is a win-win strategy for the company and your employees. Emmanuelle ROBERT, OPCO and CPF Project Manager at ORSYS, explains the terms and conditions applicable in the private sector.

1 - What is the company's role with regard to the CPF?

You might think that the Personal Training Account has nothing to do with the company, since the initiative to use the CPF to finance training lies with the person holding the account. The Mon Compte Formation platform (mobile application and website www.moncompteformation.gouv.fr) enables CPF holders to choose and pay for training courses - completely independently - using the rights registered in their individual account.

However, companies are not excluded from the scheme. In fact, the law introduces a logic of co-construction between the employer and the employee. Subject to mutual agreement, the CPF therefore makes it possible to reconcile employees' expectations with the interests of the company in a win-win situation. Companies have several cards to play when it comes to the CPF. It can, for example, authorise employees to carry out their training during working hours. It can also agree to finance part of the training. This is the case if the balance of an employee's CPF is insufficient to fund the entire course. But it is above all with co-construction contributions that it can act strategically.

2 - How does the co-construction contribution work? How does it differ from grants?

Since September 2020, on Employers and funders (EDEF), companies can allocate training rights to their employees electronically. This involves transferring training rights to employees' CPFs, in addition to those acquired through their professional activity. In just a few clicks, companies can :

- take part in individual training projects ;

- allocate additional rights to some or all employees ;

- allocate funds to meet regulatory obligations;

- pay corrective contributions.

Since December 2020, there is a new service on the My Account Training platform. It's the co-construction contributions service or the automated matching service. This service enables funders to automate their top-up policy on the basis of predefined criteria and credits delegated to Caisse des Dépôts. In other words, employers can target funding on training that is of particular interest to the company. This automated top-up policy is part of the social dialogue. via a company agreement.

More specifically, co-construction top-ups enable funders, in particular employers and regions, to :

1. select criteria that will be automatically applied to supplement the rights of targeted users

2. or focus training on jobs in short supply

It is therefore possible to define one or more top-up rules for the granting of additional funding from among three categories of criteria. Criteria linked to the beneficiary, the course and the balance available on the user's CPF. Clearly, the company has control over the top-ups it puts in place: it can target a specific beneficiary population and/or specific training courses. It is also up to the company to determine the financial arrangements. This may be a fixed maximum amount or a percentage of the initial cost of the training, subject to a ceiling.

3 - A Does a company benefit from communicating about the CPF?

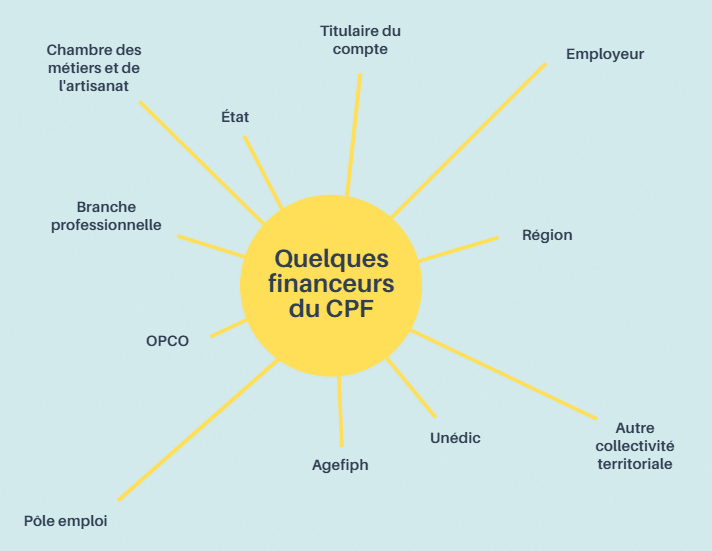

Yes, indeed. Making employees aware of the various co-financing options is a winning strategy. It's also a good idea to point out, when communicating this, that many other funders, such as the regions and professional sectors, are also likely to contribute.

The automated co-financing system is being introduced gradually. For the moment, three regions have signed a cofinancing agreement with Caisse des Dépôts:

- Pays de la Loire: the aim is to encourage employees and companies to take advantage of the health crisis to take part in training, with criteria linked to the sector of activity and type of training;

- Hauts-de-France: for jobseekers only;

- Occitanie: priority goes to employees in the aeronautical industry.

The process is also underway in the professional sectors. The OPCO Atlas has opened the ball to meet the needs of the technical consultancy sector. Other branches have also approached Caisse des Dépôts with a view to signing an agreement.

Of course, this system of co-financing benefits CPF account holders first and foremost. It can enable employees to obtain additional funding to complete their training project instead of putting it off or even giving it up. But it is also doubly beneficial for the company:

- On the one hand, it matches an employee's training project with the company's development strategy;

- secondly, it creates a additional funding within the company's training budgets.

To sum up, the CPF allows its holder to acquire €500 per year, with a ceiling of €5,000 (€800 for the least qualified, with a ceiling of €8,000). These are sums that should not be overlooked, and to which can be added potential top-ups from other co-funders.

Finally, increasing the skills of employees is always beneficial for the company.

4 - Is there still time to communicate with employees about the transfer of DIF hours?

That's right! It's the home stretch for the transfer of DIF hours, which have been replaced by the CPF. Employees have until 30 June to declare their DIF hours earned up to 2014 on the Mon Compte Formation application or online at www.moncompteformation.gouv.fr.

There's still time to remind them! They must enter their balance of DIF hours, recorded in particular on the December 2014 pay slip. If they haven't already done so, they should first create their account on the platform. It may also be useful to let them know that the hours entered are automatically converted into euros. For an employee who has never used their DIF, this can represent up to €1,800. This credit supplements the rights in euros already recorded in Mon Compte Formation and therefore increases the purchasing power of training.

After 30 June, DIF hours can no longer be accumulated and will be lost for good. While it is difficult to estimate the number of people affected by the switchover between now and the end of June, the DIF envelope still to be transferred to Mon Compte Formation could represent between 10 and 20 billion euros at national level.