In an unstable environment, purchasing negotiations require buyers to adapt and anticipate risks. But how do you go about it? Alain Wolgensinger, a specialist in international trade, takes a look at best practice.

Pressure from VUCA on purchasing negotiations

VUCA is the name given to an unstable environment:

V

Volatility

Volatility

U

Uncertainty

Uncertainty

C

Complexity

Complexity

A

Ambiguity

Ambiguity

Some characteristics of an uncertain global environment :

1/ The resurgence of inflation

The explosion in energy prices in particular has had an impact on suppliers' production costs. Some buyers have suffered non-negotiable price rises as a result.

2/ The disruptive effects of the pandemic on transport (cost of sea freight)

3/ Pressure on suppliers' offerings

International competition wants to secure supplies of strategic raw materials. For example: lithium for batteries, uranium for nuclear power, cobalt for electronics, etc.

[Also read]

How do you assess suppliers in a crisis situation?

Shortages, late deliveries and soaring prices... In times of crisis, evaluating suppliers should enable you to anticipate risks and negotiate more effectively.

4/ The sometimes overwhelming concentration of industrial know-how

While the semiconductor sector is dominated by a handful of countries, the nanoconductor sector is outright crushed by Taiwanese company TSMC. It has exclusive rights with Apple for the iPhone, iPad and Mac. And its 530 customers in 2023 are clearly spoilt for choice.

5/ Sovereign decisions by certain States

Decisions designed to protect their economies or their populations: high customs duties, banned imports or exports. With all their consequences.

Examples:

Blocked at the entrance to the US market, Chinese electric cars are seeking to enter the European market, which is both more open and divided over the barriers to be applied.

India, the world's leading rice exporter, has decided to stop exporting certain varieties (Indica, broken rice) in 2022, in order to satisfy domestic demand in a context of threatened production. This will destabilise the market and its prices.

6/ Unequal distribution of natural resources

This unequal distribution of natural resources between countries is a major source of uncertainty. This can make it very difficult for a buyer to replace a supplier at short notice.

For example:

The Democratic Republic of Congo is considered to be the richest country in the world in terms of resources. Its deposits of raw minerals are estimated at 24,000 billion dollars (copper, cobalt, gold, oil). It is also a major cocoa producer.

[Training]

Successful purchasing negotiations are the result of a fine blend of technical expertise and communication.

Find out more about the training programme: Negotiating your purchases more effectively.

[Participants speak out]

"I've learnt a lot and I'm leaving with concrete tools for my future negotiations. Aurélie

"A rewarding and well-structured course. The practical case studies make it easy to assimilate negotiation techniques. Johan

"Good balance between theory and practice. The exercises are well adapted and enable you to make rapid progress." Mickaël

To avoid being crushed in purchasing negotiations, buyers must clearly adapt and anticipate risks. In short, they need to be agile! How can you be agile?

The starting point for purchasing negotiations: analysing the competitive situation

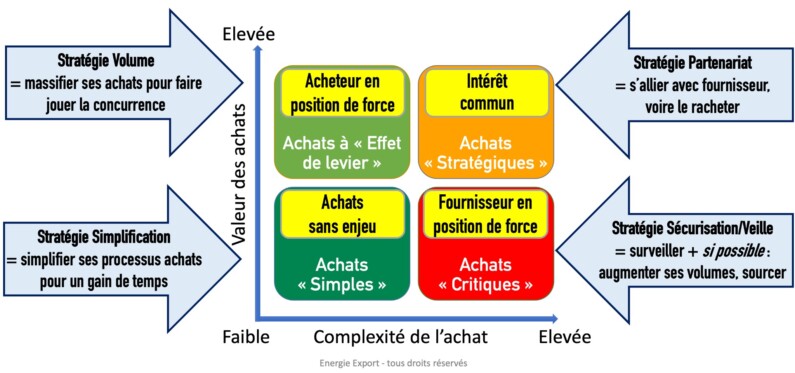

La Kraljic matrix (see diagram) is a purchasing portfolio classification tool. It helps buyers to assess the competitive situation and therefore their competitive strength. Its principle: categorise purchases according to their value (= the greater or lesser budget allocated to them) and their complexity (= the greater or lesser difficulty in finding suppliers for these products).

It's up to each buyer to analyse their own situation:

Leverage purchases

Example: standard components

The buyer: "I have a large budget that I can offer to many suppliers. So I'm clearly in a strong negotiating position. It's in my interest to negotiate for my Class A products: the 20 % of purchases represent 80 % of my budget.

→ The most rewarding and comfortable of situations. But, with VUCA, it is becoming rarer.

Simple" purchases

Example: office supplies

The buyer: "There's no point in going to all that trouble over these off-the-shelf products, with so many possible suppliers. So I opt for a purely managerial process, with no strong involvement in purchasing negotiations. Let the lowest bidder win, for the same quality.

→ A simple situation with nothing at stake.

Strategic Purchasing

Example: specific components or components with demanding certification requirements (aeronautics, in particular)

The buyer: "I can't/won't lose one of my few suppliers who can meet my requirements. Fortunately, I represent a large, and therefore attractive, budget. So we have a common interest in working together. However, it's difficult to get prices down, especially if the supplier's future or that of my supplies is threatened. The risk? Paralysing my own production".

→ A demanding, high-stakes situation.

Critical" purchases

Example: same components as above, but supplied by few

The buyer: "In addition to the difficulties in identifying the players, I have to deal with the supplier because I don't carry much weight. I can't play the big man. That would be counter-productive, if not fatal.

→ By far the most uncomfortable situation.

What impact does this have on purchasing negotiations?

On the strength of their upstream analysis, buyers will roll out their strategy like a chameleon: their negotiating stance will have to adapting to the balance of power. Not to mention the fact that VUCA could shake up this relationship.

Best practices for implementing your purchasing strategies

1/ Consolidating your technical expertise

A necessity for all categories except "Simple" purchases.

There's nothing more convincing than a seasoned salesperson who's passionate about his product, knows its unique features and can boast about them better than anyone else... and is motivated by the bonus he hopes to get if he gets the buyer to sign the contract.

The buyer must therefore perfect knowledge of the product and the market to identify opportunities.

Example :

Is a "green" car fleet a fleet of 100 % electric vehicles (and if so, for what range)? Or hybrids that need recharging? Or hybrids that recharge as they drive? Or thermal vehicles using biofuel? Or one that uses a fuel cell (hydrogen)? With manual or automatic gearboxes? Which charging points? What are the installation, maintenance and end-of-life costs? And what are the financing options (government grants and loans)? It's hard for the unprepared buyer to resist the charms of a polished demonstration.

2/ Careful communication and interpersonal relations

Beyond technical mastery, managing interpersonal relations is essential for successful negotiation.

In this way, a a respectful and balanced approach is crucial, particularly when the balance of power is less favourable to the buyer.

This is typically the case for 'Critical' purchases. But that's not all!

The proof is in the pudding:

In 2022, it was striking to see the extent to which supermarket buyers, accustomed to comfortable "leverage effect" purchases, were feeling deprived, and even battered, by sudden price rises, virtually imposed by manufacturers who could no longer cope with cost inflation. As a result, some buyers were experiencing what they had previously imposed on their suppliers, sometimes ruthlessly.

The German expression "die Rache des Kleinen" (the revenge of the little ones) reminds us of this: being harsh with a supplier can quickly backfire when the situation is less favourable to you.

So it's essential to (re)discover assertiveness: assert yourself while listening to the person you're talking to.

[Training]

Are we naturally assertive? Not really. The environment in the broadest sense (beliefs, education, culture, etc.) has a major impact on behaviour. So while assertiveness is not an innate quality, it can be learned. To find out how to work on your assertiveness, consult the training programme. Assertiveness and assertiveness.

What's more, in a globalised environment, mastering intercultural communication is another way of avoiding misunderstandings and even pitfalls.

Example :

A French buyer sent a request for quotation to a German company, with payment by documentary credit (CREDOC). This is a secure but administratively cumbersome payment technique. Its purpose is to guarantee shipment for the buyer and payment for the seller. The long-established German company was offended that its word was being questioned in this way. The French buyer had to insist, explaining that this purchasing policy applied to all first-time suppliers.

[Training]

To discover the different negotiation styles by cultural zone, consult the training programme Successful international negotiations.

[Training]

Focus on intra- and extra-Community transactions: consult the training programme Mastering Incoterms® 2020 and customs regulations.

3/ Staying awake

Preparation is one of the keys to successful purchasing negotiations. But under the VUCA effect, the cards can quickly be reshuffled.

Example :

American graphics card manufacturer Nvidia is now specialising in computing systems used by AI. It has just seen its reputation and valuation soar. The reason? The breakthrough of its OpenAI client (the creator of ChatGPT). Today, Nvidia is worth more on the stock market than the entire CAC40 combined!

Buyers therefore need to keep a constant watch on the market.

Example :

The electric car sector in China will have around 130 manufacturers by 2024. An over-confident buyer could feel comfortable in a "leveraged market" situation. But this would be doubly risky because :

1/ This very large number of suppliers conceals the fact that it has actually shrunk since 2019 (when there were 500 manufacturers). This drastic reduction indicates that the market is consolidating, leading to mergers, takeovers and even bankruptcies. As a reminder, Citroën, France's leading carmaker, went bankrupt in 1934, but was fortunately taken over by Michelin in 1935!

2/ How do you know that the future victims won't be your suppliers?

4/ Establish a clear roadmap

Planning the purchasing negotiation is also essential. The buyer must therefore define precise stages with clear objectives and set limits to avoid being trapped by an unfavourable contract. A well-constructed roadmap makes it possible to stay focused on long-term objectives.

Last but not least, it helps to put things into perspective if the buyer's situation is too unfavourable.

[Case study]

Notebook manufacturer Sourceclaire* regularly needs recycled paper pulp. But this is a highly speculative market, with prices fluctuating wildly over the year, and there are not many players. Although Sourceclaire has a good reputation in France, it is not a major international player. On the face of it, its situation is not a comfortable one. At best, the manufacturer is in a "strategic" purchasing position. At worst, it is in a "Critical" purchasing situation if demand is too strong to allow it to influence its few suppliers.

Its strategy: buy in volume when demand is lowest and sellers are no longer in a position of strength. By favouring quality grades. Admittedly, stocks then increase. But it's for a good cause, and the product is unlikely to become obsolete!

It also needs new fibres, which compensate for the broken fibres in recycled paper, to produce quality paper. Sourceclaire finds them in wood. Eucalyptus in particular. Disadvantage: the major players in this species are few and far between. Most of them are in South Africa, Brazil and Australia.

Faced with a Critical" purchasing situationIn response, Sourceclaire began looking for alternative species. It approached the Wood Competitiveness Cluster to study other fibres (hemp, bamboo, wheat straw, sugar cane). She also increased her visits to international trade fairs and conferences. Finally, she discovered that a forestry sector producing eucalyptus was emerging on the Iberian peninsula, bringing new players to the market. With them, she put her European proximity and its quality brand image (the carrot rather than the stick).

Sourceclaire's perseverance is paying off: its situation is now close to "Strategic" purchasing. What's more, it has maintained its margins despite energy price rises.

*This fictitious case study is intended to provide a concrete illustration of the concepts discussed in this article. This case study is intended to be representative of strategies aimed at improving purchasing negotiations.

In conclusion, even in an uncertain and complex environment, a structured approach to the purchasing function can make all the difference.